Your Remote Tax Advocates

We help individuals and businesses resolve IRS challenges, maximize tax savings, and ensure accurate filings with secure, expert-led remote services. No stress, or uncertainty—just the trusted guidance you need to take control of your taxes with confidence.

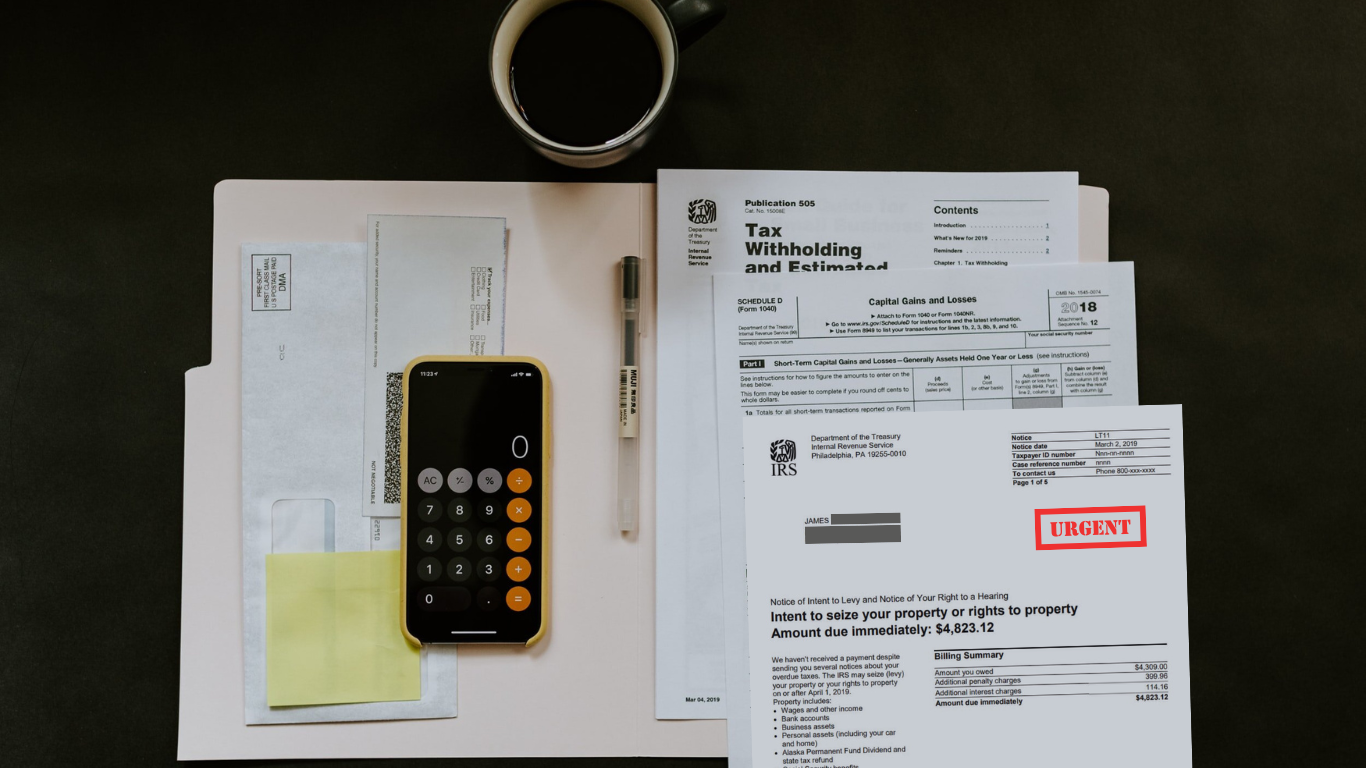

Message to Taxpayers

Dealing with tax issues and IRS notices can feel overwhelming, but you’re not alone. Many notices are automatically generated and use intimidating language, but our team is here to provide clarity, support, and expert guidance.

With a compassionate approach, we help you navigate challenges with confidence, ensuring you stay informed and in control. Take a deep breath—you’ve got this, and we’re here to help.

IRS Notice Support

Expert IRS Notice Support for audits, penalty reductions, and tax relief solutions.

Tax Consulting & Projections

Strategic advice for complex transactions, ensuring compliance and minimizing liabilities.

Virtual CFO Consulting

Leverage financial statement analysis, key ratio reviews, and a detailed look at your books to identify money leaks.

Tax Return Review

Catch errors, optimize deductions, and ensure compliance for a stress-free filing.

IRS Transcripts Retrieval

Quick, secure access to tax return, account, and income records when you need them.

Exempt Organization Applications

Preparation and submission of required forms, ensuring compliance with IRS regulations.

Contact us.

Have questions about your taxes? Let our experts walk you through your options, answer your questions, and help you find the best path forward.